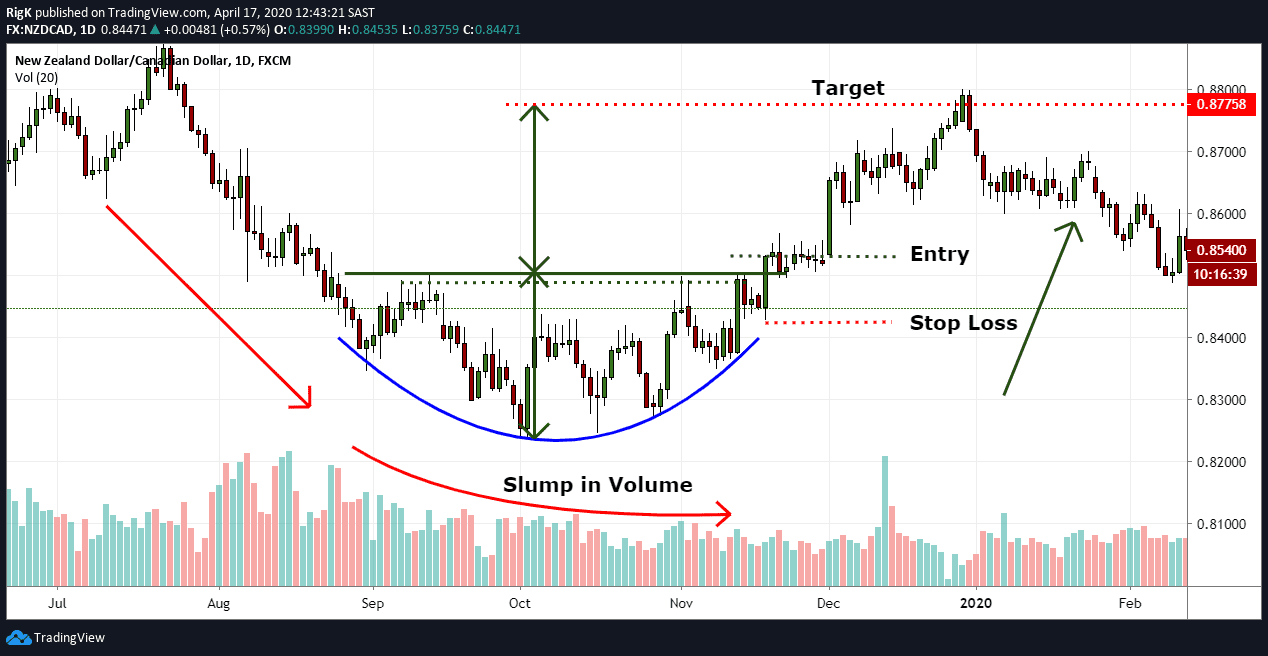

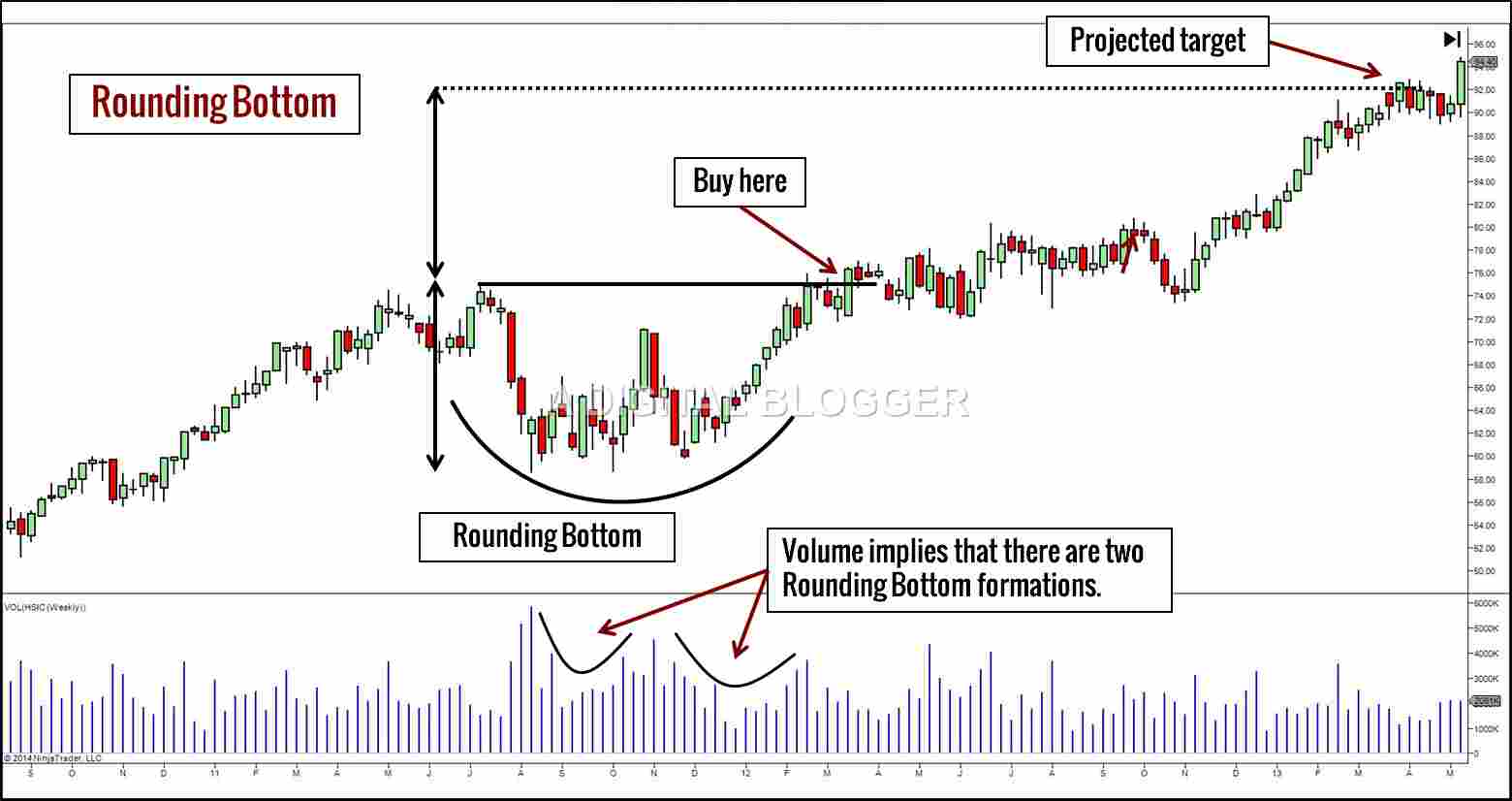

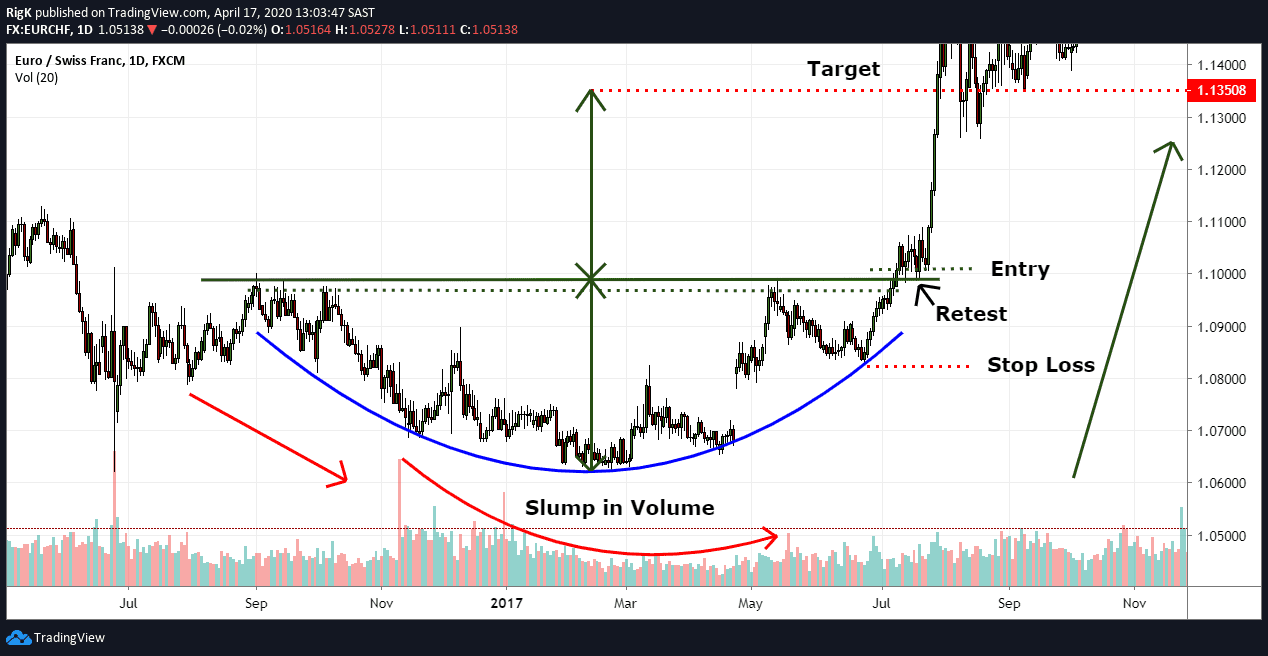

The rounded bottom or saucer pattern is formed by taking a curved line to connect minor lows over the course of many days to a few months. The advance of the first bottom should be a drop of 10 to 20 then the second bottom should form within 3 to 4 of the previous low and volume on the ensuing advance should increase.

Weekly closing price is crossing above weekly 100200ema in between last 5 weeks.

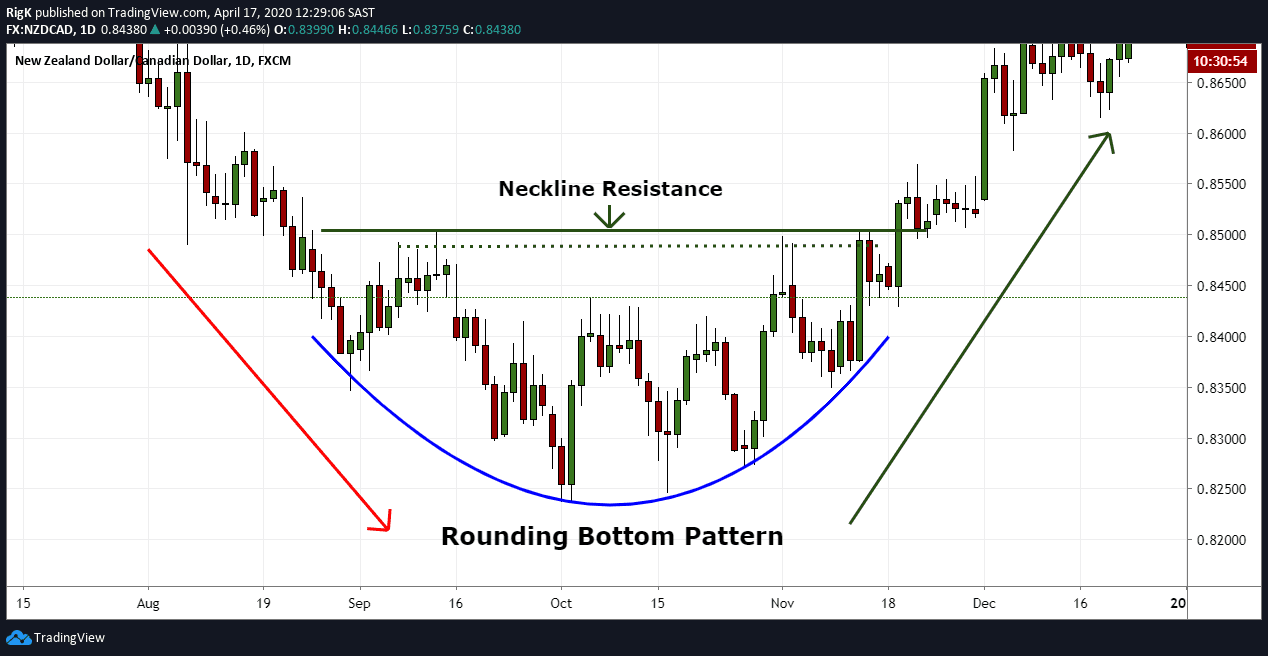

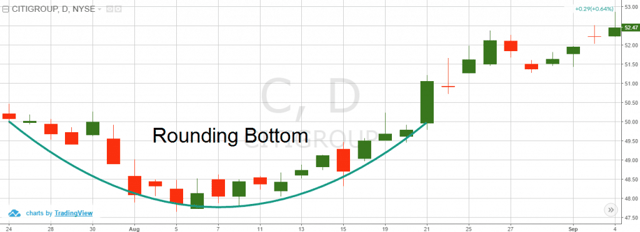

. Unlike sharp V-like price movements rounded tops and bottoms have a U-like appearance and occur over the course of several weeks or months. Breakout patterns can occur when a stock has been trading in a range. A prevailing bearish trend.

Rounding bottoms are found at the end of extended downward trends and signify a reversal in long-term price movements. The 20-day SMA is below the 34-day EMA. This pattern is considered complete once price finally breaks and closes above the neckline.

Here are the criteria for the rounded-bottom breakout. A Rounded Bottom is considered a bullish signal indicating a possible reversal of the current downtrend to a new uptrend. Learn more about breakout trading here.

The rounded top pattern appears as an inverted U shape and is often referred to as an inverse saucer in some technical analysis books. If the stock breaks through either end of this range its a breakout. A rounded bottom or saucer pattern is not a common pattern but is highly reliable as a reversal pattern with bullish implications.

When it breaks above resistance we call it a breakout. Below support is a breakdown. The rounding bottom is typically followed by a reversal upward in.

The rounding top pattern is used in technical analysis to signal the potential end of an uptrend and consists of a rounded top sometimes referred to as an inverse saucer and a neckline support level where price failed to break through on numerous occasions. First resistance r1 2 x pp low first support s1 2 x pp high. Weekly closing price is higher than last 20 weeks close.

This chart pattern is considered complete once price finally breaks. First level support and resistance. It signals the end of an uptrend and the possible start of a downtrend.

The first portion of the rounding bottom is the decline that leads to the low of the pattern. The chart needs to be a downtrend and the longer the downtrend the better. The Rounding Top Pattern Explained.

The rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart. Candlestick breakout of the neckline. The rounded bottom pattern appears as a clear U formation on the price chart and is also referred to as a saucer.

The rounding bottom pattern is used in technical analysis to signal the potential end of a downtrend and consists of a rounded bottom-like shape with a neckline resistance level where price failed to break through on numerous occasions. The low during this time needs to have held and not been tested allowing for upward sloping sides. Rounded Bottoms are elongated and U-shaped and are sometimes referred to as rounding turns bowls or saucers.

Now is the time to go through the Double Bottom chart pattern strategy step-by-step guide. This Means That AAVE is ready to do a Massive Jump in its priceas you might know the price can Increase as much as the Measured Price movement which in This case is as big as the Height of this Pattern so It means the bullish Potential For AAVE is pretty Big and It can Reach Its ATH. Identify the Phase of the Market.

To trade the double bottom breakout youll basically need just three things. The following Chart shows Rounded bottom for Indusind Bank also a Morning Start Candlestick pattern is formed on the weekly chart. Hi every one AAVE TETHERUS AAVEUSDT has Just Formed a rounded bottom.

Pivot point-without restriction-5 min-monthly - Pivot point pp high low close 3 support and resistance levels are then calculated off the pivot point like so. A Rounded Bottom is considered a bullish signal indicating a possible reversal of the current downtrend to a new uptrend. The actual trigger is.

Two equal bottoms at the support level. How do we identify a rounded bottom pattern. Trade with our Sponsor Broker.

Rounded Bottom Breakout Pattern The chart needs to be a downtrend and the longer the downtrend the better. Other Indicators also indicate Upside Movement RSI MACD Recent Breakouts of Nifty Will also help push this stock price. The top of the range is resistance and the bottom is support.

Conversely the rounded bottom is a long-term bullish reversal pattern that signals the end of a downtrend and the possible start of an uptrend. The pattern is confirmed when the price breaks out above its moving average. There are five stages to rounded top and bottoms.

The 20-day SMA is below the 34-day EMA which is below the 50. There should be a bottom formed such that the chart is trading sideways forms a double bottom and has clearly reached. The rounding bottom is a reversal chart pattern which develops after a price decline.

This patterns time frame can vary from several weeks to several months and. Rounded bottoms occur at the end of downtrends and often will take much more than a few days to form this chart pattern. Weekly scanner - Weekly close or emas crossing above 305075100200 weekly emas for current or crossing above 100200 weekly emas within a 5 weeks period.

The Rounding Bottom Pattern Definition Examples 2022

The Rounding Bottom Pattern Definition Examples 2022

Rounding Bottom Reversal Chart Pattern Youtube

Step By Step Guide To Trade The Rounding Bottom Pattern Tradingsim

Howto Trade Chart Patterns Rounding Bottom Reversal Trading Systems 3 December 2014 Traders Blogs

Rounding Bottom Pattern Step By Step Guide To Use Rounding Bottom

:max_bytes(150000):strip_icc()/RoundingBottom2-0a1514186d454d4b9e4fba32aed39f24.png)

0 comments

Post a Comment